Dynamic Currency Conversion (DCC)

Earn additional revenue for foreign exchange transactions

Foreign transaction fees and currency conversion fees all go to the bank. DCC from Planet cuts the bank out and puts the money from these fees back into your bank account. No hidden fees - customers know exactly what they are paying.

Best Rate Guarantee. No additional fees.

What is Dynamic Currency Conversion (DCC)?

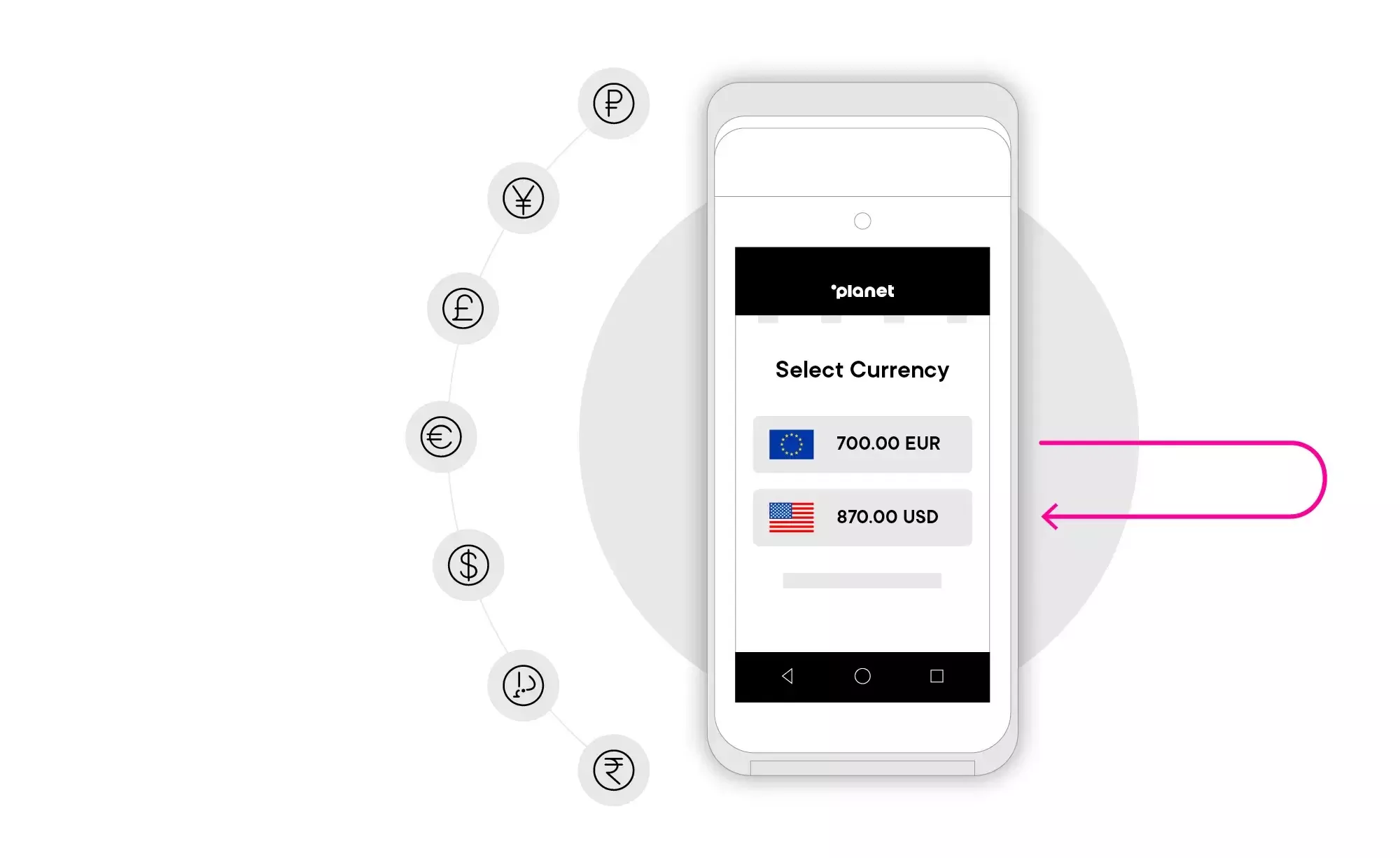

DCC (Dynamic Currency Conversion) is a payment service that offers international customers the choice of paying in their own currency when paying by Visa or MasterCard rather than in the merchant’s local currency.

DCC is designed to help international travellers pay for products and services in their own currency. It is a process whereby the amount of a card transaction is offered at the point of sale, ATM, or at the online payment page in both the Merchant currency and to the currency of the card.

Benefits of Dynamic Currency Conversion

What you need to know

FAQs

DCC Transaction (Customers' Currency)

When a customer chooses to pay in their own currency (DCC option), the currency conversion process is managed by Planet (not by the customer’s bank). Foreign transaction fees are charged to the customer at the point of sale and shared between the retailer, the acquirer and Planet.

Standard Transaction (Merchant’s Local Currency)

In standard transactions, the cardholders' bank manages the process in the customer’s card currency, taking the Merchant and Planet out of the equation. As a result, the customer's bank earns foreign exchange commission. The transaction is authorised and completed a few days after the purchase, exposing the customer to an unknown foreign exchange rate.

Planet provides detailed statistics and reporting to Merchants, including:

DCC hit rate, with breakdown by currency

DCC opt-out rate, with breakdown by currency

DCC Profit & Loss

Unsupported DCC currencies and relevant values

Payment in customer’s home currency, whilst merchant is still settled in local currency

Currency conversion is carried out by Planet and not the customer’s bank.

Foreign exchange commission is included in the total purchase amount displayed to the customer, in real-time, on the payment terminal at the point of sale.

Over 100 currency choices on offer, including EUR, GBP and USD.

DCC creates additional revenue for the merchant and is available across different solutions. Card machines, POS terminals, eCommerce.

Planet currently provides 5 US Banks with Bin/ICA support. Planet also offers other payment solutions for card transactions to the US market.

4-6% per cent for branch locations and 6-8% for off-premise ATMs.

Planet has been offering DCC at ATMs since 2012.

The United Kingdom, USA, Mexico, Bahamas, Spain, UAE and Malaysia.

Brexit has made the £GBP cheaper and the Euro more expensive, so it’s better to pay in £GBP.

Customers think service providers are double charging them.

Customers do not know about the Best Rate Guarantee, ensuring they cannot lose out and don’t pay additional fees.

Card schemes backed by banks promote DCC rates as more expensive.

Some banks decline DCC transactions or send the customer a text message telling them to refuse DCC.

Debit cards/credit cards are not accepted.

What happens next?

Talk to one of our experts today

- We will call you to outline your exact needs - a quick 15-minute call.

- Once we understand how best to assist you, we can initiate the hassle-free onboarding process.

- Finally, a dedicated consultant from Planet will reach out to get you operational as soon as possible.